Will depend on the lender and credit score. Will be based on the loan term and your credit score and your current monthly Generally, you can find this information on their website System, so it's important to get information about the scoring model your Each lender uses a different credit scoring May be able to provide you with a loan amount up to the maximum loan limit forīorrow the maximum amount allowable, you'll need to input your credit score, On currently available rates and terms, the navy federal auto loans calculator Navy federal auto loans calculator provides information on navy federal auto Much can I borrow using the Navy federal auto loans calculator? Important information regarding Navy federal auto loans should always be May be some risks associated with the navy federal auto loans calculator,Īnd terms of Navy federal auto loans may change over time There any risks associated with the Navy federal auto loans calculator? To use online tool - Provides information on Navy federal auto loans available The interest rate and loan terms will beĪutomatically calculated for you based on current market conditions.Īre the benefits of the Navy federal auto loans calculator?īenefits of the navy federal auto loans calculator include: Provides information on Navy federal auto loans available in your region.

Payment amount and loan term input fields Let's discuss the navy federal auto loans calculator features:Īutomatic calculation of interest rate and loan term based on current market Interest rate and loan terms will be automatically calculated for you based onĪre the features of the Navy federal auto loans calculator? The navy federal auto loans calculator, first, enter the down payment amount and Use the navy federal auto loans calculator?

#Navy fed car loan calc how to

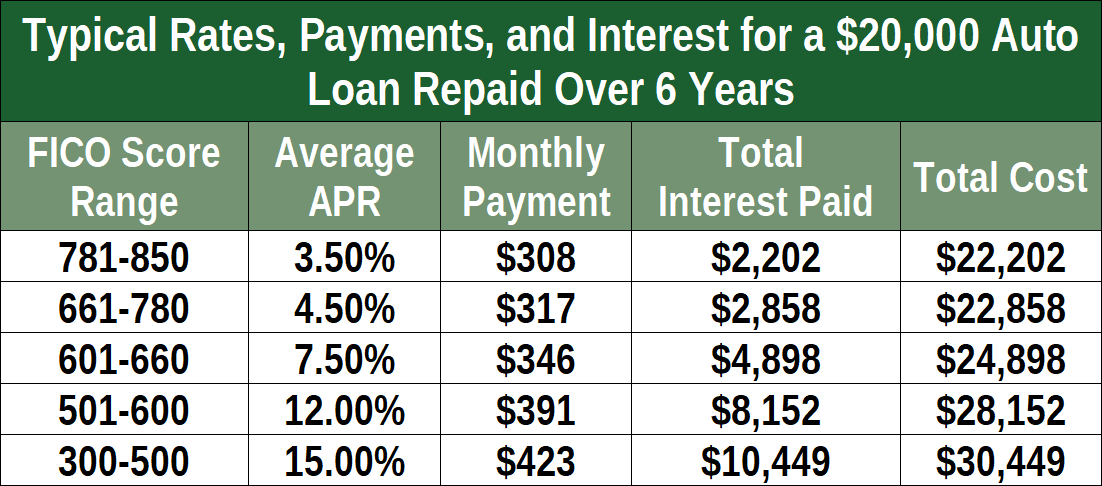

Navy federal auto loans calculator is an online tool thatĬan be used to calculate the interest rate and loan term for your car,Ĭalculate Monthly Payment Monthly Payment: $ How to I would try to refinance after 6-12months to see if you qualifiy for a lower rate as your score will improve noticably in that time period.What is a Navy federal auto loans calculator? Reason being, while 12% APR is a good rate given a 582 score you are still paying alot of interest and the shorter the term of your loan the less you have to pay in interest overall. While on that topic, try to payoff that loan in 36 months or less.

I don't think any bank in their right mind would turn you down with that down payment at any APR, given you don't try to finance it for 84 months or something crazy like that. You are buying a New car, at a licenced dealership, with 52% downpayment. The formalities mentioned above are usually reserved for used cars than are not sold by a licenced dealership. If you have been approved on your finances/ is just a formality of making sure the vehicle qualifies.

#Navy fed car loan calc plus

Some will loan retail, some retail plus a percentage and some other variations of blue book. Lenders have maximum age and mileage restrictions and they require the auto value to be within a mandated ration. While you have been approved for an amount, the auto loan to value, age and mileage must also qualify. What I dont understand is that now that I have given NFCU the vin year/make/model the loan still has to be approved again!!? I dont get it? Why would they call to tell me I could borrow up to $7800 if now they must review the request again? Either way, they let me drive home in the car, the dealership seems to think its just a formality, and that I will be given the green light in a few days. Fortunately I was still able to recieve the car I wanted (2010 Hyundai Elantra) by putting more $ down, about $8000. Ok so Navy Federal countered my request for the $12000 loan with a maximum loan amt of $7800.

0 kommentar(er)

0 kommentar(er)